Indian stock market may now be priced to perfection

Indian equities have surged 18% in greenback terms to this point in 2017, essentially the most among the world’s 10 greatest markets. With market value at $1.ninety one trillion, the very best on account that January 2008, the return displays 10% expansion in price-revenue (P/E) more than one as well as rupee appreciation. but, the sustainability of these elements seems sketchy, therefore, the talk whether Indian equities are ‘priced to perfection’ — whether valuations fully mirror positive triggers.

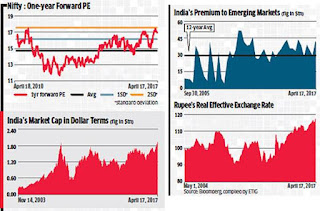

The Indian market trades at 16.9 times FY18 projected revenue, a 20% top rate to long-time period moderate and one certain same old deviation faraway from imply. The farther it's faraway from mean, the upper the chance of it returning to the mean, statistically often called imply revert. excluding for technology and healthcare stocks, most Nifty ingredients are valued a lot greater than their long-term average.

probably the most critical issue for top rate valuation, cash boom, has no longer been encouraging. Barring commodity stocks, most Nifty’s materials have considered cash downgrades. additionally, the consensus estimate has hyped up earnings increase for the fifth yr in a row. A report by means of credit score Suisse said India is the third worst amongst higher emerging markets, behind Mexico and South Africa, in over-promising and under-delivering on salary growth previously 15 years.

India’s valuation top rate in opposition to different rising markets can also be widening, touching 40.8% in April towards 12-yr moderate of 30%. On sector-adjusted basis, MSCI India trades at 19 occasions 12-month income, a 58% top rate to the emerging market mixture. It means a pointy rise has made market expensive in absolute and relative phrases.

On the currency front, the rupee is among the strongest for the reason that start of the 12 months as a result of excessive certain real interest rates. overseas portfolio investors invested $9.1 billion in Indian equities and debt in March.

VISIT - Adviser Street

Comments

Post a Comment