Global fund managers betting on melt-up in equity markets before the meltdown

So gung-ho area unit fund managers regarding stocks that the proportion of them disposing of protection against a near-term correction within the markets has born to a four-year low

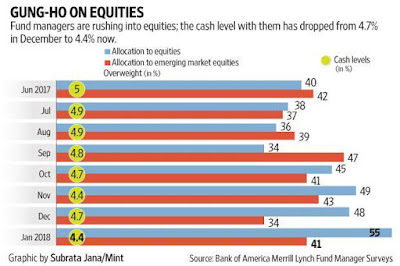

Fund managers area unit dashing into equities. The Bank of America Merrill kill survey of world fund managers for January shows that the money level with them has born from 4.7% in December to 4.4% now.

Are the markets heading into an ardent “melt-up” phase?

Most of the money has gone into equities, with allocations at their highest since March 2015. thus gung-ho area unit fund managers regarding stocks that the proportion of them disposing of protection against a near-term correction within the markets has born to a four-year low. web hedge fund equity market exposure is that the highest since 2006.

Most investors still believe a mixture of above-trend growth and below-trend inflation that has been dubbed the Linosyris vulgaris state of affairs.

In December, investors had pointed to higher inflation as drawback favored for Linosyris vulgaris. In January, inflation expectations area unit at their fourth highest since 1995, however at an equivalent time they're determined to remain long on equities till they see signs of inflation poignant earnings.

What might cause the party to end?

Inflation and a bond crash is that the main tail risk. near the fund managers surveyed cite second quarter or third quarter of 2018 because the seemingly peak, whereas half-hour see equity markets peaking in 2019 or on the far side.

In December 2017, the majority of them aforementioned equities would peak in 2018.

For More Detail:- http://www.adviserstreet.com/

Contact Us:- 08818888127

Fund managers area unit dashing into equities. The Bank of America Merrill kill survey of world fund managers for January shows that the money level with them has born from 4.7% in December to 4.4% now.

Are the markets heading into an ardent “melt-up” phase?

Most of the money has gone into equities, with allocations at their highest since March 2015. thus gung-ho area unit fund managers regarding stocks that the proportion of them disposing of protection against a near-term correction within the markets has born to a four-year low. web hedge fund equity market exposure is that the highest since 2006.

Most investors still believe a mixture of above-trend growth and below-trend inflation that has been dubbed the Linosyris vulgaris state of affairs.

In December, investors had pointed to higher inflation as drawback favored for Linosyris vulgaris. In January, inflation expectations area unit at their fourth highest since 1995, however at an equivalent time they're determined to remain long on equities till they see signs of inflation poignant earnings.

What might cause the party to end?

Inflation and a bond crash is that the main tail risk. near the fund managers surveyed cite second quarter or third quarter of 2018 because the seemingly peak, whereas half-hour see equity markets peaking in 2019 or on the far side.

In December 2017, the majority of them aforementioned equities would peak in 2018.

For More Detail:- http://www.adviserstreet.com/

Contact Us:- 08818888127

Comments

Post a Comment